Data Points you have to know! - 26th Feb'22

All views are personal and for educational purposes only, please do your own research before investing and trading

Hi

Welcome to the February Edition of Data Points where we discuss some data points that can directly impact markets or a segment of markets

Let’s Begin

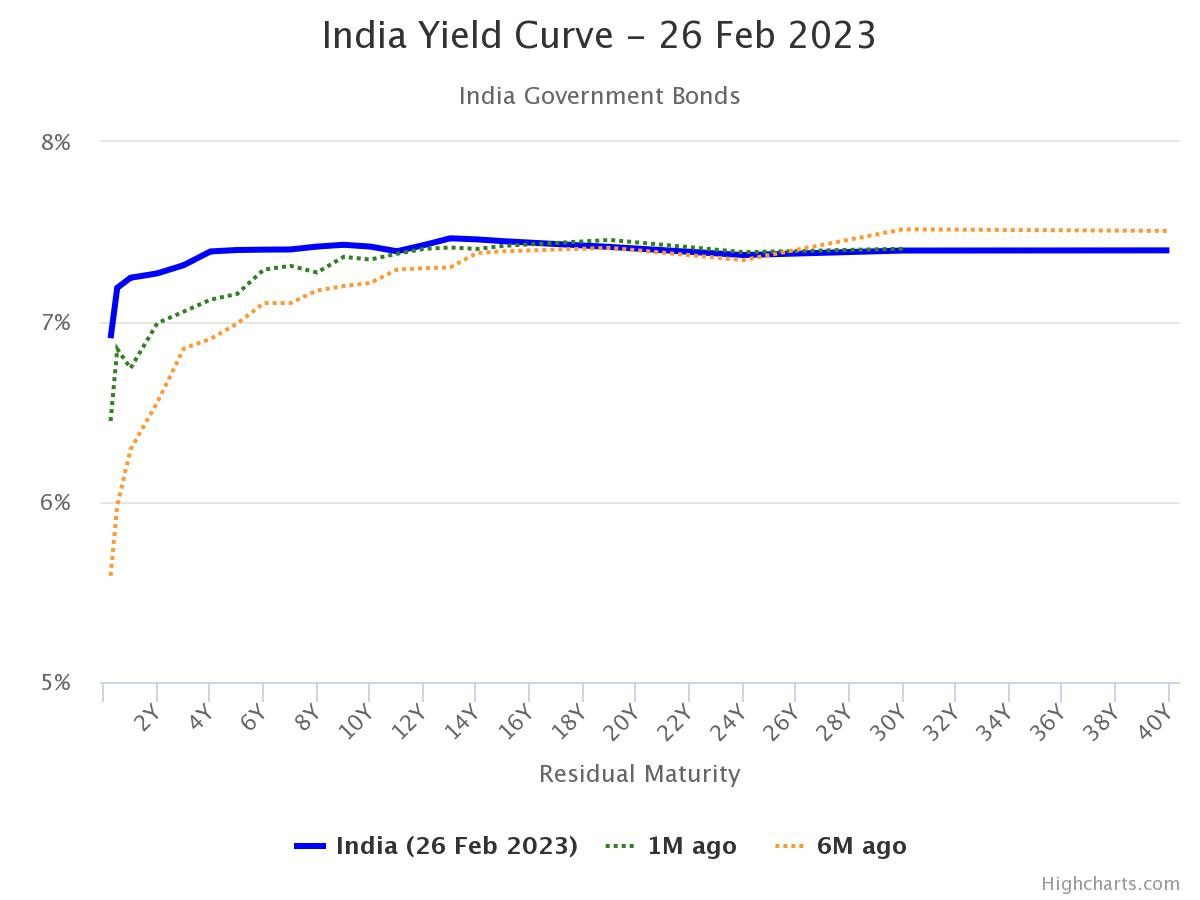

Yield Curve

The yield curve of India has become pretty flat and there’s hardly any spread between the yields of various maturities.

Bodes extremely well for short-term savings that anybody might have, however not so well for the overall economy.

FBX Container Prices

FBX global container index is down to similar levels as 2020.

This easing of container rates bodes well for logistics cost of many companies.

At the same time, companies involved in providing these services who would have recorded a large gain in the past 1-2 years could see a drastically different performance in the coming quarters.

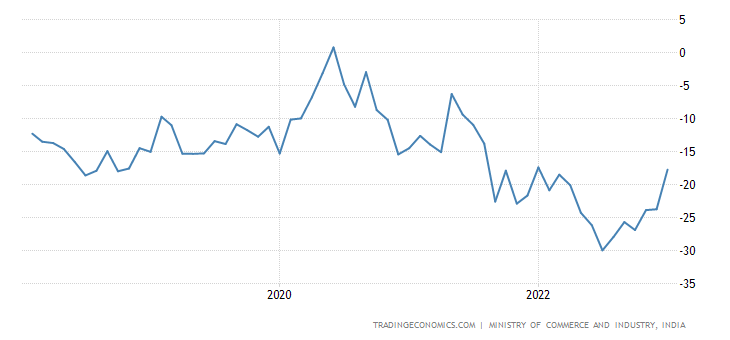

Balance of Trade

India’s balance of trade deficit which suffered quite a bit in the latter half of 2022 has started to contract.

However, it’s wider at $17.75 Bn in as compared to $17.42 Bn last year for the same month.

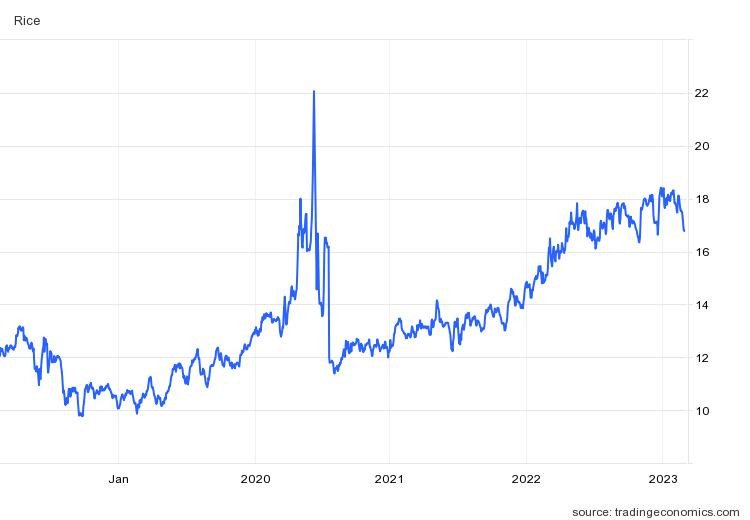

Rice

Rice has had a good run in the past ~2Y however it appears that the momentum has started to fade and the prices seem to be consolidating.

Well, that’s it for this article, hope you explore the above data points and add it your analysis of the securities in your portfolio.

Until then, keep manifesting wealth!

Disclaimer: All above views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.

Website: Manifestwealth.substack.com

Twitter: @Manifest_W

LinkedIn: Manifest Wealth

Sources: