How to better pick commodity stocks?

All views are personal and for educational purposes only, please do your own research before investing and trading

Introduction

Hi

One of my favorite investing books of all time is “Value Investing and Behavioral Finance” by Parag Parikh

The book is a gold mine in itself and everyone should read it but today we are focusing on what was discussed in one of the chapters that deals with commodity investing

In the book, the author highlights how choosing high-cost producers instead of low-cost producers may lead to a better outcome

The reasoning shared was:

Low Base Effect: The lower margins of high-cost producers would boost faster - easier to go from 5% to 10% than from 20% to 40%

High Debt: High-cost producers could also have higher debt which is a fixed cost and as such the rise in top line would have a higher translation on the bottom line

Debt Reduction: During good times, the company would rotate the debt to favorable terms resulting in lower interest costs and higher profits

Tax Benefits: The older losses of the company help the company save taxes when they do make a profit, boosting the bottom line

Re-Rating: Since the company was doing worse before (high debt, high cost, low margins) hence when the sector does get re-rated during the commodity runs it can translate to a higher return

A partial basis of this logic is in the concept of how operating leverage (and leverage in general) plays out for commodity stocks during their cycles

I’ve covered how it works with an example on steel companies sometime back

Check it out here:

https://manifestwealth.in/2022/10/23/what-happened-to-the-steel-commodity-super-cycle/

So, does it work?

Well so we picked 10 Steel and Steel Related Companies with an Mcap>2000 to keep the lessons to a test

Stocks Selected:

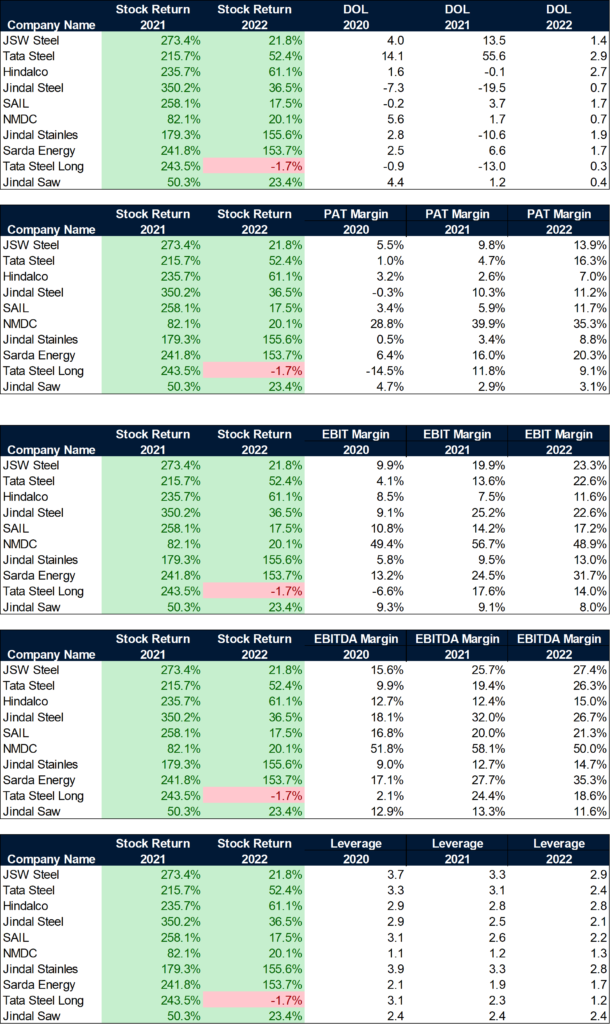

Returns & Fundamentals:

Note: the price return taken here is for the respective financial year

By looking at the above we’d reach similar conclusions as to what has been pointed out in the book:

By looking at the change in EBITDA, EBIT & PAT margins and the stock returns above we can see that the stock gains were higher for high-cost producers as evident by stocks like Jindal Steel & Tata Steel which did well and NMDC which didn’t do as well as its peers

If one were to look at leverage - measured by assets / equity - we see similar story playing out with leverage decreasing across the board for the most part as the times became better

We also see that although Jindal Saw didn’t see any noticeable improvement in margins or leverage, it still did quite well

Conclusion

Now this isn’t to say that just buying companies that are high-cost producers during downcycles at beaten up valuations would guarantee great returns

In fact, even the data doesn’t precisely support that aspect, since even decent companies did fairly well - not as great, but not bad either

What I’d like the readers to take away from this post instead are 2 aspects:

The importance of understanding leverage and operating leverage plays in commodity stocks and how that can help you play them better

Old and tested methods do have some merit and it’s wise to read up on them and then test it out to see if they can still work, and if it makes sense, adopt them to your process

Until next time, keep manifesting wealth

If you liked this article subscribe to get similar articles every Sunday directly in your inbox

[newsletter_form type="minimal"]

Disclaimer: All above views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.

Website: Manifestwealth.in

Twitter: @Manifest_W

LinkedIn: Manifest Wealth

Sources:

MoneyControl

TickerTape

Investing.com