Manifest Wealth: Editor's Portfolio as of March

This post is for disclosing my biases. It is not an investment advice and shouldn't be taken as endorsement of the stocks.

Hi,

Often as part of content creation, people do ask me from time to time, “where do you invest?”

I do believe sharing my portfolio is one of the best ways to stay transparent.

I also believe it can serve educational purposes by showing my reasonings and advantages of various instruments and diversification.

By no means any of this is investment advice and I do not recommend in any shape or form to copy my investments either wholly or partially since what works for me may not for you and I’m not a registered investment advisor.

Disclaimer: All below views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.

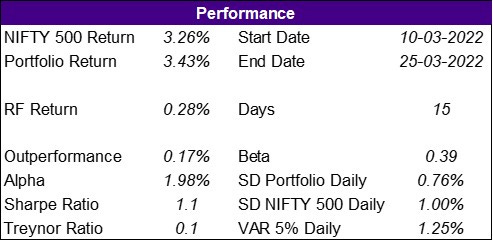

Performance

I use NIFTY 500 as the benchmark for my portfolio since it’s spread across market caps and asset classes.

I am happy that in the short amount of time considered I’ve beaten the index and have less risk. However, since it’s only a short term, it’s not a complete representation and I can only hope this continues in the long run.

The start date for my comparison is March 10th, 2022, since data before this was distorted because of my F&O trading.

I’d go through my entire portfolio below which would include:

Investment by Asset Classes

Investments per asset class (Equites, Bonds, etc.)

Investment by Asset Class

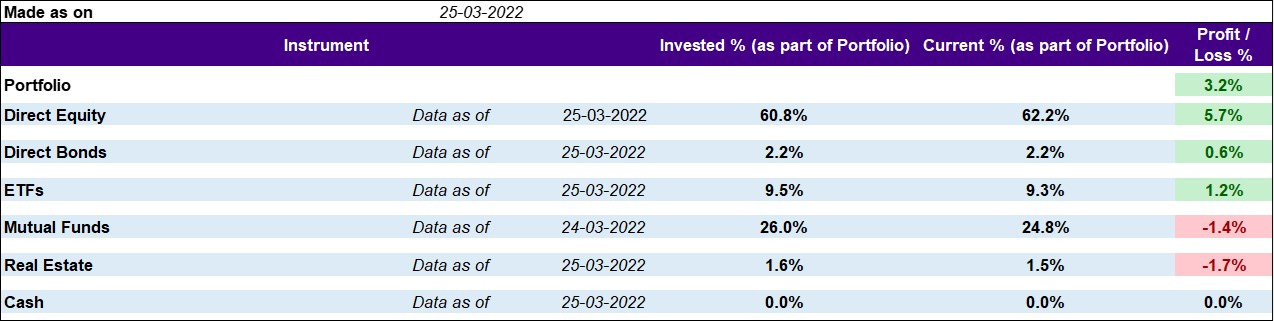

Most of the investments in the above portfolio have been made recently in the past 3 months (As shown below).

Since there’s also certain capital movement in the portfolio, the return in current portfolio is different compared to my actual return shown above. (The portfolio return doesn’t consider realized gains)

Moving on to my individual investments.