Manifest Wealth: Indian Markets Weekly View - 27th March 2022

All views are personal and for educational purposes only, please do your own research before investing and trading

With this week being sideways, many wonder if this is a consolidation before a rally and a time to enter? or is it that the recent upwards movement is simply a pullback and a bearish momentum is upcoming?

Let’s find out.

But before we begin:

Moving on to the Weekly View!

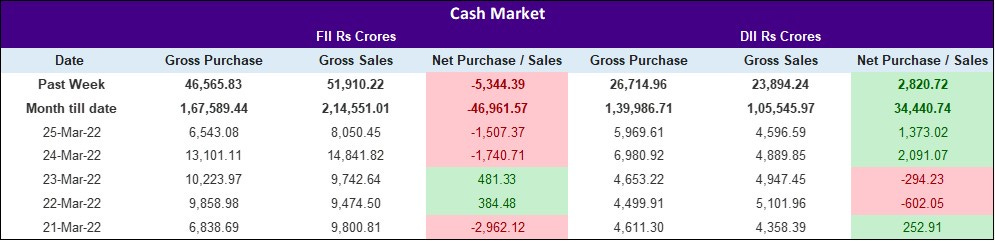

Institutional Data

FIIs sold again last week however with some buying in between.

By the looks of it, the institutions may seem to continue being sideways before earnings are released, with a slight negative bias.

The global tensions certainly don’t help.

In my view, the institutional data is neutral

BANKNIFTY View

BANKNIFTY couldn’t maintain its position above 200EMA for long and fell below it by the week’s close.

This isn’t a positive sign. Moreover, RSI also seems to not be in divergence and hence this can be a beginning of a fall.

In my view, BANKNIFTY is Bearish, and I’d be focused on the important support levels.

Upwards the important resistance levels would be ~36100, ~37500, ~38400.

Downward the important support levels would be ~34750, ~33100, ~32150.

INDIAVIX View

INDIAVIX while was on a downturn has stopped falling and may rise again.

This bodes negatively for NIFTY but may provide long term investors time to pick up stock amidst the fear.

I find INDIAVIX to be going up this week, which is in turn Bearish for NIFTY.

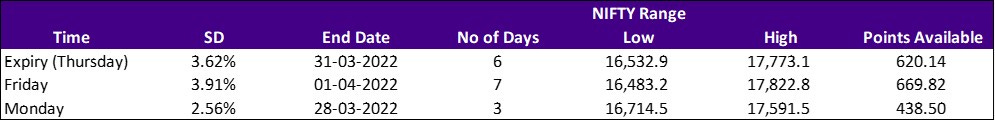

Here are the VIX Range levels for this week:

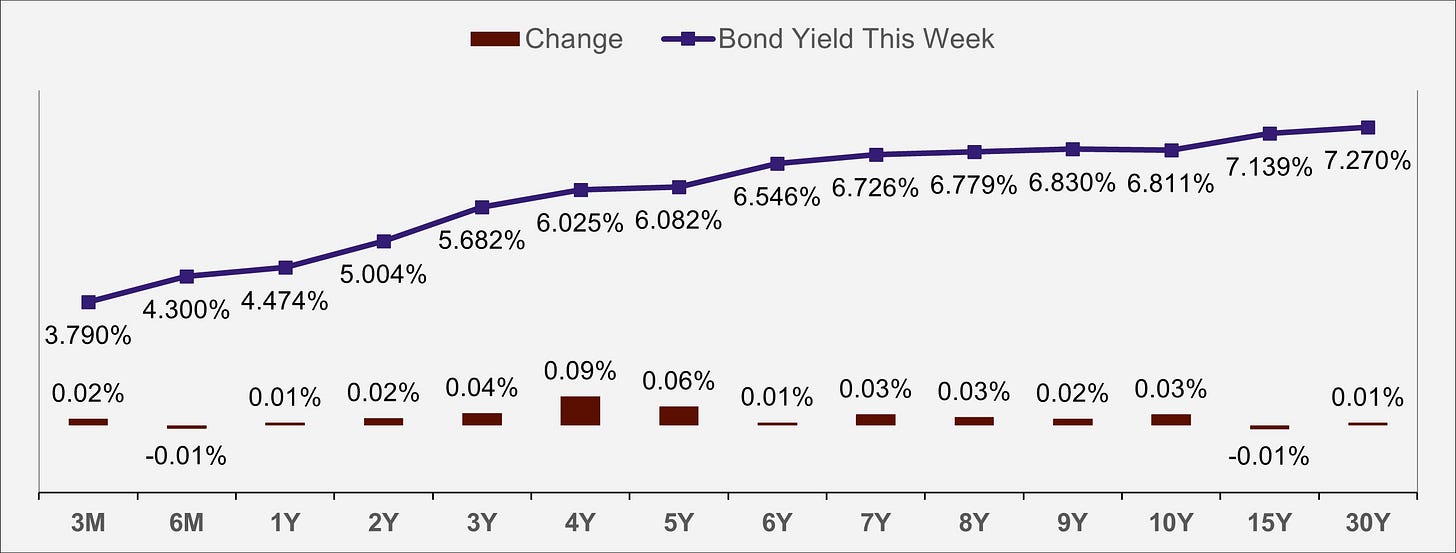

Yield Curve View

The yields have rose this past week however not evenly. Long term yields remain primarily flat with medium term yields slowly becoming closer to them.

The change alongside last week’s change makes the curve appear flatter, which doesn’t bode well for NIFTY.

Thus, in my view, even the yield curve signals bearishness for NIFTY.

NIFTY View

NIFTY has been primarily sideways in the past week and is above the 200DEMA.

But the question is for how long? since BANKNIFTY seems to be bearish and there’s not much interest in the global front as per the institutional data and nor does the yield curve paint a rosy picture.

The RSI is already falling, signally bearishness as well.

There’s another aspect that the next week is the last for the fiscal year and we may seem some tax loss harvesting.

In my view, NIFTY is posed to fall in the coming week and I’m as a result, Bearish.

Upwards the key resistance levels would be ~17250, ~17650, ~18000, ~18300.

Downward the key support levels would be ~17000, ~16900, ~16720, ~16400.

Disclaimer: All above views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.

Join 65+ Intellectual Readers (5+ Premium Readers) who are manifesting wealth and are receiving the weekly view alongside financial concept explainers, monthly premium research, and access to editor’s portfolio.

If you want to share the gift of manifesting wealth, do share the newsletter