The Relationship between Gold and NIFTY - The Weekly Manifest

The following is personal research on the topic and shouldn't be taken as a financial advice. It is meant to simply educate and pass on facts as well as my opinions on the topic.

Gold is probably the most famous metal on Earth.

Not only it can be seen as one of the first currencies but is also seen as an investment option by many.

Businesses have flocked around this metal directly and indirectly - Jewellery, electronics and even financing.

Our research aims to evaluate an investment in gold as part of the portfolio in relation with NIFTY as the market.

Here the INR gold prices are based on XAU/USD spot prices, adjusted for Indian rupee using the prevalent exchange rates.

The following research consists of:

Detailed Comparison of NIFTY with Gold returns (Adjusted and non-adjusted for currency depreciation) - including risk measures and correlation over multiple time frames

How gold can change a portfolio return and risk metrics

Back-tested results with 5%, 10%, 15%, 20%, 25% and 30% of portfolio allocated to gold using ETFs for a close to realistic explanation

Feel free to skip to the bottom of this exhaustive research to get your actionable insights in short!

Let’s Begin!

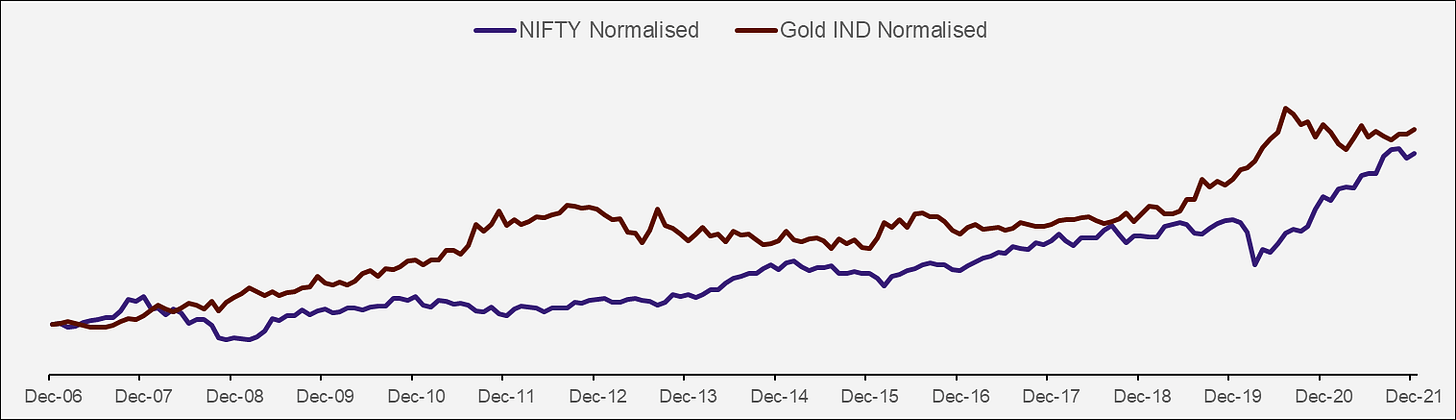

NIFTY and Gold Spot (In INR):

Surprised? I was too!

Had you invested Rs 100 Back in January of 2007 in Gold, you’d have comfortably outperformed NIFTY (excluding dividends)

On 31st December 2021 you’d have Rs. 484.79 (CAGR 11.10%) for every Rs. 100 invested in Gold vs Rs. 437.53 (CAGR 10.34%) for every Rs. 100 invested in NIFTY.

Does this mean Gold>NIFTY?

Not really.

Here we need to discuss two aspects before declaring the above:

The above is a point-to-point comparison, so we need to verify does gold beat NIFTY over different periods consistently.

Second is a bit more nuanced - The gold prices used here are based on two things - XAU/USD or the gold spot traded globally and the USD/INR or the exchange rate of the Indian rupee with regards to USD

If we derive a simple equation, it’d be:

Return on Gold INR = Return due to Gold USD + Return due to USD/INR

Since rupee has been primarily a depreciating currency, the extra return in Gold INR could be attributed to it

Gold Return Attribution:

By comparing the two returns it’s easy to see that while the moves of Gold USD and Gold INR are similar, the depreciating currency makes the price change in INR much larger.

Gold Spot in USD has only given a CAGR of 7.28% over the past 15 Years, much lesser than the 11.10% we attributed to Gold in INR and 10.34% of NIFTY.

The currency has depreciated at CAGR 3.55% (As the exchange rate has risen on this rate) - This makes sense economically as the average inflation in India between 2007-2022 was ~7% and for US was ~2%.

If we were to compare only gold returns in USD with NIFTY:

As is evident now, the return if one invested in Gold (USD) would be closer to 7.28% compared to NIFTY’s 10.34%

In value terms a USD 100 investment in gold would be USD 287.12 where as a Rs. 100 investment in NIFTY would yield almost double at Rs.437.53

(Note the currency difference)

One more thing to note here is that the 7.28% return is in USD Terms and as such has USD inflation (Currency Depreciation) built in.

So why the need to showcase this?

The answer:

Gold INR’s Return as compared to Gold USD was 30-35% more based due to currency depreciation caused by high inflation in India vs the US.

As India becomes a developed economy in the next 15-20 Years, the inflation would come down and as such the gold returns would become like the ones we see in US

Hence, this data helps us ascertain our expectations better

One thing to also note here is that NIFTY’s growth is also imbued with inflation.

So far, we know only two things:

Gold INR over 15 years has outperformed NIFTY

Gold INR’s specular return over those 15 years has 30-35% attribution to our currency depreciation

Let’s now see how NIFTY and Gold have done across periods (Loads of Graphs Below)

Studying the relationship over time shows two things:

Gold is relatively stable than NIFTY over time

Most of the outperformance of the Gold comes from not moving downwards as much when NIFTY does

Gold usually remained flat when NIFTY performed

There’s little to no correlation usually except when NIFTY is going down.

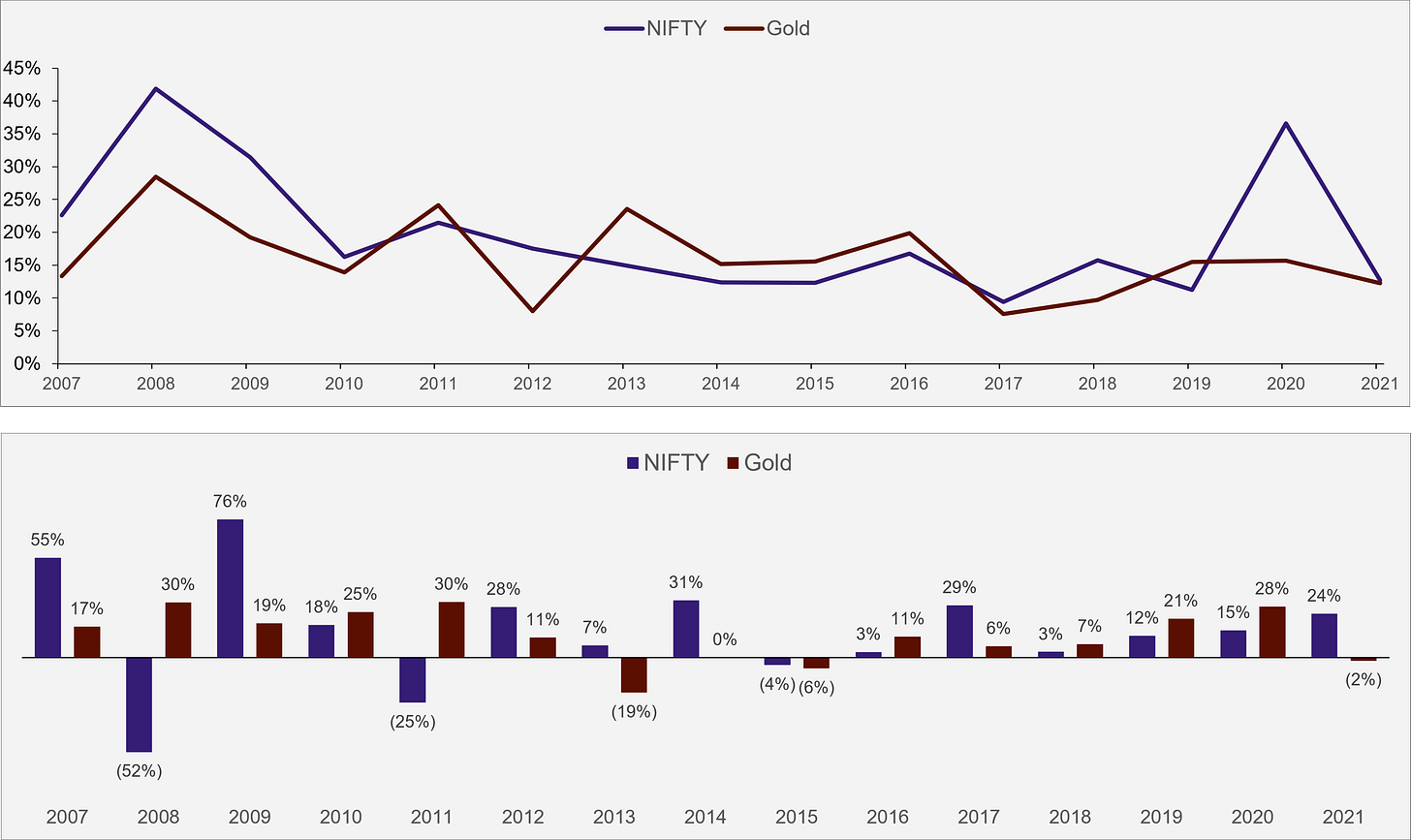

Lastly let’s compare the volatility over time:

Here we learn:

Uncertainty (Volatility) in Gold is lesser than NIFTY over time

Intensity of Gold falls is far lesser than NIFTY Falls

NIFTY achieved a higher return than gold only in 8 out of 15 years or about 53% of the time

Higher volatility in NIFTY may be seen with higher returns in gold

Higher volatility in Gold may be seen with low returns in NIFTY

Why Add Gold to Your Portfolio?

Hedge against currency depreciation

Lower Uncertainty than NIFTY

Low to No Correlation with NIFTY

Performs when NIFTY doesn’t

Doesn’t have large drawdowns

Thus, adding Gold could give diversification benefits

Back testing Portfolios

Pointers for Back testing:

We will be using two ETFs - NIFTY Bees and Gold Bees to build a NIFTY-Gold Portfolio as they are highly liquid ETFs

The prices are based on NSE prices

Rebalancing is done at the beginning of the month

Lookback period is 10 years

Not accounting for brokerage, slippage, taxes and other expenses

The only expense considered are the mgmt. fees of the ETFs which are built into their NAV

Performance will vary slightly if other ETFs would have been used since each ETF’s tracking error would be different

0% Gold is a NIFTY only portfolio & 100% Gold is a Gold only Portfolio

The performance below is representative and is not financial advice.

The idea behind this is to just get an understanding of how does the allocation help.

Quarterly Rebalancing:

Bi-Annual Rebalancing:

Annual Rebalancing:

Backtesting Observations and Conclusions

Please note that this is a point-to-point back testing, hence it’s not as exhaustive, so the aim here is not to make golden rules but give an idea of what to expect

In the past 10 years from a point-to-point comparison, investing about 15-20% in Gold would’ve worked out to be the best to increase Sharpe Ratio

Quicker Rebalancing offers low increase in returns and since this is a point to point, there might be a scenario where opposite is true.

It might be a better idea to do the asset allocation only yearly since the expense of doing so would be lower which is more controllable as a factor.

NIFTY portfolio unsurprisingly gives higher returns but would also have higher drawdowns as discussed earlier in the article

Gold can be a good measure to reduce volatility and safeguard money

Additionally, it can be a good store of money to buy the Dips in the market, however that would require a higher level of skill

Takeaways:

Gold can be a good safeguard against volatility and times of uncertainty

Gold Returns are higher during times of currency depreciation

Skilled investors can use gold to store cash to “buy the dip” as it remains uncorrelated

It can be helpful in case one needs to take out money during times of large portfolio drawdowns

It might be a better idea to rebalance NIFTY-Gold Portfolios only yearly since the expense of doing so would be lower which is more controllable as a factor and there isn’t a substantial increase in returns by doing it more frequently

Over long term however NIFTY returns would beat NIFTY-Gold portfolio simply as NIFTY has higher returns than gold over long durations as seen over multiple time frames

For Risk-Seeking investors, Gold may be just a method to store cash as the risk in volatility may not seem as pleasurable however if it’s the sole purpose there are other alternatives for this

Hopefully this expanded your knowledge about the relationship between Gold and NIFTY

Until next time, keep Manifesting Wealth

Best,

Aryan

Disclaimer: The above research is purely for educational purposes and is not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.