Manifest Wealth: Understanding Return on Equity

This content is part of our Financial Awareness Initiative and is a deep down on logic behind Financial Concepts

Return on Equity (ROE) is one of my favourite ratios

Why?

Because it shows me how much of my capital in the books is making me money.

This is important as while the share price reflects the company’s value, the book value of the shareholder’s funds show how much money of the owners is invested in the business, I.e., You.

The net income shows how much profit or loss we have made.

And so, ROE gives us how much of the owner’s money invested has been made back by the business at the end after all expenses.

Why is it important?

Well at the end of the day, we invest in a business to earn money.

ROE is exactly that, how much do we earn on the money.

A company with an ROE of 20% would mean its profit is 20% of its shareholder’s funds

What this means is if you owned this business and had invested Rs.100 to start this business, you’d have made Rs.20 in the end.

Breaking down ROE

Let’s assume you want to start a Momo stall!

You do the following in the year:

Buy a steamer for Rs. 1000

Buy a battery to power the steamer for Rs.500

Buy a storage cooler to store the non-cooked momos for Rs.100

Buy Rs. 200 worth of veggies

Buy Rs. 300 worth of oil

Buy Rs. 100 worth of flour

Spend another Rs. 100 on miscellaneous items

Sell momos worth Rs. 1000

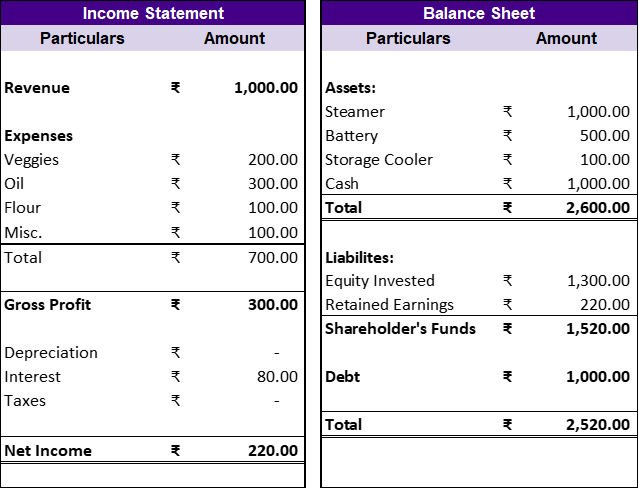

So, your Financial Statements would look like this:

So, we see you’d have made Rs. 300 as your profit on your initial investment of Rs. 2300.

Now since Rs. 2300 is what your initial investment was and Rs. 2600 is what you had at the end, on average throughout the year you had Rs. 2450 Invested in your stall.

Since you earned Rs.300 in the entire year, that gives you a 12.24% Return on your money invested and that is your ROE.

In other words, every Rs. 100 in the business makes Rs. 12.24.

Expand this into a big public company and you’d realise since at the end of the day business is business, this can help understand how your money is performing.

Further, since this is the money added to the company’s equity capital, we can use this as a proxy of how the company’s book value is going to be in the company years. (Do note Dividend Payout affects this)

For example, if the stall keeps making 12.24% as its ROE in about 6 years, you’d have made back all your invested capital (As a business, not on the stock). You can already see why it’s our favourite ratio, right?

Du-Pont analysis is where we break down ROE into 3 parts:

Net Profit Margin:

How much do equity earners earn for every 1 Rs. of Revenue

Way to measure the profitability of the venture

Asset Turnover Ratio

The amount of sales generated per 1 Rs. of Assets

Way to measure how efficiently the assets are used

Leverage

How much money is invested in the business as times of owner’s money in the business

Way to measure leverage or debt levels of a business

The idea behind du-pont is to figure out the way the business is generating the ROE and compare the process between similar companies in the same sector

Questions we could ask are “Is ROE high because they are efficient or is it simply because they have cheaper financing from outside?”

Lastly let’s cover leverage

Take the same momo stall but this time you’ve taken money from your parents, a Rs.1000 loan @8% interest Rate.

Because of the loan, you only had to invest Rs. 1300 of your own money.

You did have to pay interest on the Rs. 1000 though which amounted to Rs. 80.

In other words, you paid Rs. 8 for every Rs.100 you took as loan.

Since your business however made Rs. 12.24 for every Rs. 100 invested, including on all those Rs.1000 you took from your parents as well, you made a cool Rs. 4.24 for every Rs. 100 of the loan or a total of Rs. 42.4 for yourself with Rs. 0 invested.

And thus, Your ROE increased because of that cool extra Rs. 42.4 you earned because rather than keeping your own money in you chose to pay a fixed rate which was lower than the return on business.

Now yes ROE is higher but if we were comparing companies, we’d look at du-pont to understand this change and we’d see this!

Your underlying business didn’t really improve, infact, your net profit margin reduced!!!

This is a crucial point to note for analysis - an increased leverage may increase your ROE but obviously impacts profitability since there’s a fixed expense.

Infact if you take in too much debt and your net profit fall short enough, you might even have less ROE than without Debt!

So, debt is a double-edged sword. It can both increase the money you make on your money or decrease it.

Understanding Tax Shield

Now one thing to understand is that debt gives you tax shield.

What that means is since the expense of interest occurs before taxes are calculated you may end up paying less tax.

In other words, while you do have to pay Rs.80 as interest, had your tax rate been 10%, you’d have not had to pay Rs.8 tax that you’d have otherwise.

(Since now your tax is on Rs.220 instead of Rs. 300, so your tax expense is Rs 22 instead of Rs 30)

Thus, your actual incremental decrease in net profit would’ve been only Rs. 72 (From 270 to 198)

Hence, we say that debt also gives tax shield or tax savings.

Hopefully, this post has answered all your questions regarding ROE, Du-pont Analysis, how leverage impacts ROE, and Tax shields.

Why not share this with your peers and spread the knowledge of finance?

If you enjoy such articles or want any of the below benefits, do subscribe below to join a community of 50+ Readers who are Manifesting Wealth

Weekly view on NIFTY And BANKNIFTY - Every Sunday at 11AM IST

Articles on Financial Concepts - Every Saturday at 11AM IST

Quality Financial Research - Every 2nd Saturday of the month 4PM IST

A look into my portfolio - Every 4th Saturday of the month, 4PM IST

Disclaimer: All above views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.