Manifest Wealth: What we ignore about Beta

The following is an opinion of mine and isn't financial or investment advice.

One of the first words that pop up when we talk about risk is beta

But what is beta?

In common parlance, it’s a measure of systematic risk.

Or in other words how much do systematic factors that affect the market affect the stock.

The common way to measure this is by using a regression between the market returns and the stock returns over a lookback period and then taking the coefficient which explains the stock movement.

The coefficient is also the slope of the line of best fit.

Lastly, the other mathematical way is to take the covariance of the returns and divide it by the variance in market returns.

They all lead to the same result since they are all mathematical derivatives of the same logic.

With this approach, however, comes a shortcoming.

Temporary differences during the lookback period in prices of a stock can lead to beta being higher or lower.

Which is why some use the approach of taking the beta of the peers of the stock, de-leverage the beta, use the average de-leveraged industry beta and adjust it for the leverage of the stock.

The logic being the leverage plays a role in determining how risky the stock is compared to the industry and the deleveraged beta of the stock determines the industry’s systematic risk.

Now comes the first kicker, I don’t particularly believe beta is a great measure of risk for a single stock or when looking at a stock in isolation, here’s why.

When you buy a single stock, you’re still exposed to all risk factors that the stock is exposed to.

Unless you’ve a portfolio that you’re adding the stock and your portfolio is well diversified to reduce the unsystematic risk of the stock, the measure of beta for the stock is pretty useless.

What would be more prudent risk wise is volatility or the total risk since you’re not diversifying away your stock specific risk.

If anything, we might end up having a worse idea about our risk since even if it has a low beta, the stock could be risky, in fact riskier than higher beta counterparts.

How?

Join 70+ Intellectual Readers who are manifesting wealth and are receiving the weekly market view alongside monthly premium research, and insights from the editor.

Let’s look at the definition of the beta again to understand this

I’d use the formula since that’s the easiest to explain this idea with

Beta = Covariance/Variance of Market Returns

Covariance = Correlation Coefficient * SD of Stock Returns * SD of Market Returns

The correlation coefficient is what is overlooked in most people’s definitions

Correlation is a big factor of course. Why?

Well, you see, Total risk is based on SD of a stock

Expanding everything

Variance of the Market Returns = SD of Market Returns * SD of Market Returns

Beta = Correlation * SD of Stock Returns* SD of Market Returns / (SD of Market Returns^2)

In other words,

Beta= Correlation * SD of Stock Returns / SD of Market Returns

I guess things are clearer now than before

Say you’ve two stocks, one with SD of stock returns at 20% and other at 10%

The SD of market return is 10%

The correlation 0.5 and 1

Beta in both cases?

Company 1 = (0.5*20%*10%) / (10%*10%) = 1

Company 2 = (1*10%*10%) / (10%*10%) = 1

In both the cases, the Beta was 1

The unsuspecting would feel, both stocks are equally risky

Now we are not wrong here, in fact if the stocks are put in a portfolio where this unsystematic risk is diversified away, all we are left with is the risk as per beta and they’d be same.

Infact by having a well-diversified this is exactly the benefit we get - the ability to add stocks with substantially higher total risk and diversifying the unsystematic risk away.

However, most of us do not have well-diversified portfolios.

We tend to focus around 2-4 sectors, which sometimes are more than interlinked.

Simply a number increase in stocks isn’t diversification, but more on that some other time.

Coming back to our tryst with beta

We saw how two stocks with totally different total risk profiles can have same beta.

Now think of it this way.

What if the correlation is 0.3 for one of the stocks.

This isn’t really that rare to happen since most of us, myself included, use NIFTY 50 as the benchmark

Moreover, NIFTY 50 has a lot of bias towards financials (>35%) followed by IT (>15%) followed by oil and gas (>10%) combined they make up around >60% of NIFTY’s weightage and as such its direction.

And a stock which isn’t in NIFTY 50, or not in these industries can very easily have a lower correlation (not beta)

This is also the reason some small caps in sectors which are not one of the three mentioned above would have abysmally low beta, making investors think the stock is low risk when it might not be the case.

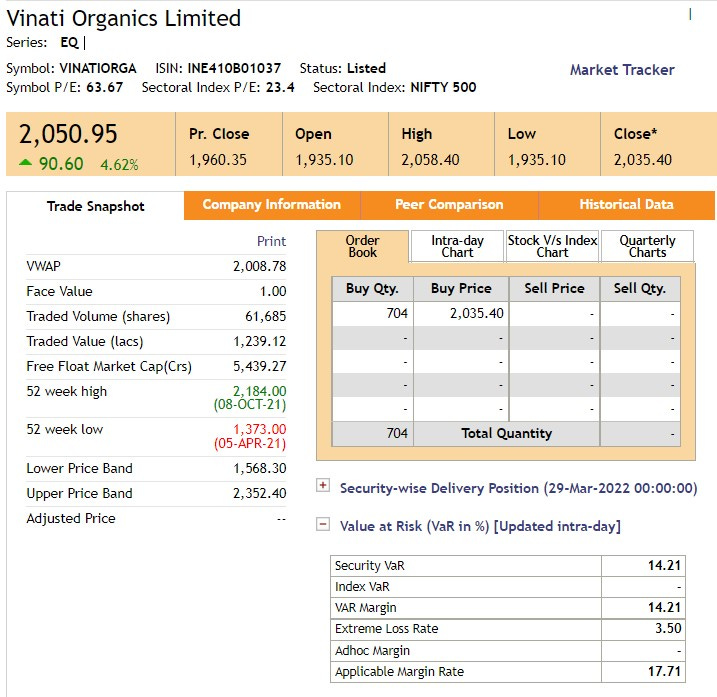

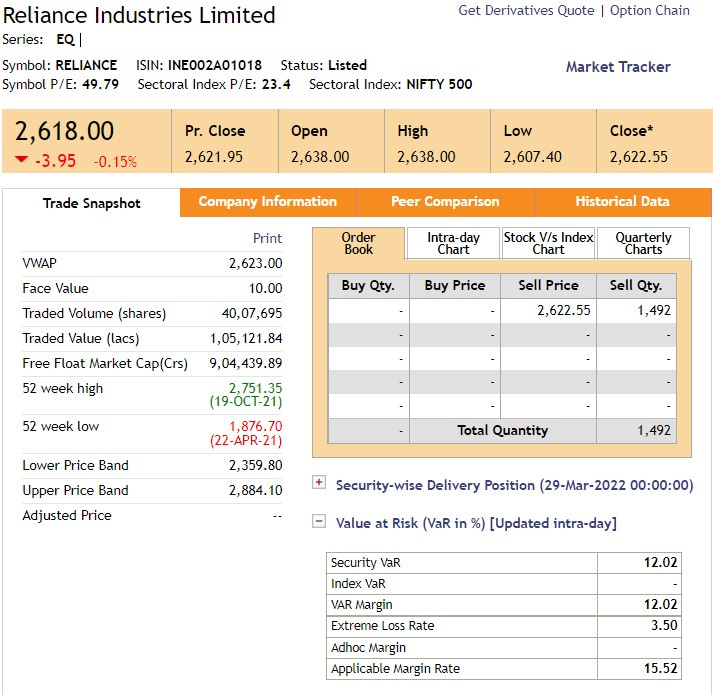

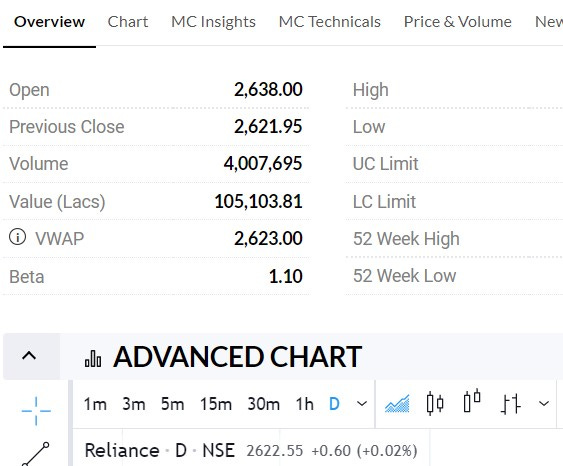

Here’s an example of Reliance (A Large Cap Oil & Gas stock) and Vinati Organics (A Mid Cap Chemical Stock)

Check out the VaR - which is a measure of total risk like volatility, showing the minimum extreme loss and Beta.

As we can above, Reliance has a higher Beta than Vinati Organics (1.10 vs 0.48) however the VaR of Vinati Organics is higher than Reliance (14.21 vs 12.02)

Hence why I believe one should look at not only the Beta but also other risk measures.

Infact, one additional thing to note, Beta is simply the coefficient in regression as pointed our earlier.

The coefficient in statistics helps understand how much the movement is in one variable is cause by the other variable(s)

So honestly, beta can also be taken as how much of the movement is explained by the index.

Now whether that’s a good measure of systematic risk is what I leave up to you to decide

Lastly, if your portfolio is well diversified, Beta is a good measure since your portfolio would have its Unsystematic risk diversified away to a large extent, resulting in beta being a good measure, however the above points regarding the stock’s individual risk would still exist such as beta for a stock being misleading.

Now I don’t mean Beta is not a good risk measure, the takeaway of this writeup simply is:

Beta under regression is how much movement of a stock is explained by NIFTY or systematic factors

This is a good measure if we add the stock to a portfolio and the unsystematic risk is diversified away

However, Unsystematic risk may not always be diversified away due to portfolio construction that may be present

Moreover, Beta is mix of SD of a stock and its correlation, in case the index has low correlation it may have a low beta, giving an image of minimal risk but may be extremely volatile and risky.

Hence, it’s prudent to see other risk measures as well like Volatility and VaR that can explain the total risk and use these to compare risk of stocks

Using correlation with index can also give a better picture of the Beta of a stock

Beta is a good portfolio metric since in those scenarios unsystematic risk is diversified away

Essentially, one should understand Beta is a measure of systematic risk and its only one element of risk, which could become smaller as % of total risk as we move on to riskier companies as times, hence one should investigate other risk factors as well.

Until next time.

Disclaimer: All above views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.

Join 70+ Intellectual Readers who are manifesting wealth and are receiving the weekly market view alongside monthly premium research, and insights from the editor.

If you want to share the gift of manifesting wealth, do share the newsletter