The world of passive funds beyond NIFTY50

All views are personal and for educational purposes only, please do your own research before investing and trading

Hi,

With markets falling this week, some might be looking to start buying

I’ll refrain from commenting if it’s the right time to buy or not as in my head SIPs and time in the market always wins over timing the market

Hence, the topic of this conversation is a bit different, it’s about showing where one can SIP

Now we all know index funds are the way to go, most active managers aren’t able to beat the index consistently over time and the usual sayings

And all of that has merit, but most of us feel index funds refers to buying NIFTY and often in chase of higher returns are willing to go with active strategies

Which while fair, other ways do exist to achieve the desired results

Today I’m going to talk about the world of passive funds beyond the usual NIFTY, Sensex, NASDAQ, and the likes as well as smart beta funds

Do check out our pre-made investment templates store: Notable Templates by clicking here

Introduction

Now before we begin, let’s understand what are Passive and Smart Beta funds?

Passive funds are funds that try to imitate how an index performs, hence are also known as index funds

Now these indices can vary from being based on Mcap like NIFTY 50, NIFTY Midcap to style indices like NIFTY Alpha 50 or Momentum or ESG indices

Now when we deviate from market capitalization indices like NIFTY into something like NIFTY Alpha 50, we get into the realm of Smart beta funds

These can be taken as somewhere between Index funds and Active Funds

They operate on pre-set rules and don’t have direct human decision making intervention on each stock just like index funds and at the same time they also aim to outperform Mcap indices, take into factors other than Mcap, consider investment styles and risk, among other things like active funds do.

Best of both worlds? Maybe

Now the question remains, how do these other index funds and smart beta funds stack up against NIFTY?

Read on below to find out:

Mcap Indices

Let’s first look at comparing the Mcap indices

To keep this brief here’s the list of Mcap indices for this comparison:

NIFTY 50 - Benchmark

NIFTY Next 50

NIFTY Midcap 150 / NIFTY Midcap 100 (Also referred as NIFTY Midcap)

NIFTY Smallcap 250 / NIFTY Smallcap 100 (Also referred as NIFTY Smallcap)

NIFTY 500

Now I had to compare it from 2019 (3 years ago) since that’s when NIFTY Midcap 150 and NIFTY Smallcap 250 price return data on trading view was available from

Now pretty much everything beats NIFTY except junior NIFTY, however 3 years is a short time, and we had momentum for a long time in that timeframe.

Now since Midcap 150 and Smallcap 250 data isn’t available, I’ve replaced them with the standard Midcap and Smallcap index

So, one thing’s that seems to be recurring is NIFTY Small cap (which takes 100 small cap stocks) underperforms even though one would think it’d not

This could be due to the fact that SmallCaps frequently gain and lose Mcap and are more susceptible from being dropped, going bankrupt and not performing well

This could also mean Smallcaps are areas where alpha can be generated due to the information asymmetry increase that occurs as we go down the Mcap

Lastly, it also shows that mindlessly taking extra risk doesn’t help

NIFTY held on to itself in 5 years but not so much over the longer duration where other indices barring Smallcaps were able to outperform it

Now this doesn’t mean NIFTY is inferior, risks are a thing so let’s compare their fact sheets

Total return here refers to the price return and the other return generated (Dividends, etc) which would be reinvested back into the index

NIFTY pretty much is a great bet compared to other indices when looking at this, especially from a risk perspective, furthermore, the beta of other indices is lower due to their correlation and not that their absolute risk is lower (except in case of NIFTY 500)

One more thing to know here is NIFTY50 is a pretty large (>50%) component of NIFTY 500, hence why they have performed similarly

Mcap indices seem to be in favour of NIFTY50 being a better bet, although some other indices have outperformed, especially in times of momentum

Do style indices fair better? let’s see

Style / Strategy Indices

When it comes to smart beta funds and strategy / style indices I’m sticking to indices which have ETFs / funds and not inhouse strategy based smart beta funds from fund houses (as they are mostly new) or indices which exist but without an ETF - as the aim of this is to eventually be something that can provide more actionable insights

Indices:

NIFTY 50 equal weight

Nifty 200 Quality 30 Index

NIFTY Alpha 50 Index

Nifty Alpha Low-Volatility 30 Index

Nifty 50 Value 20

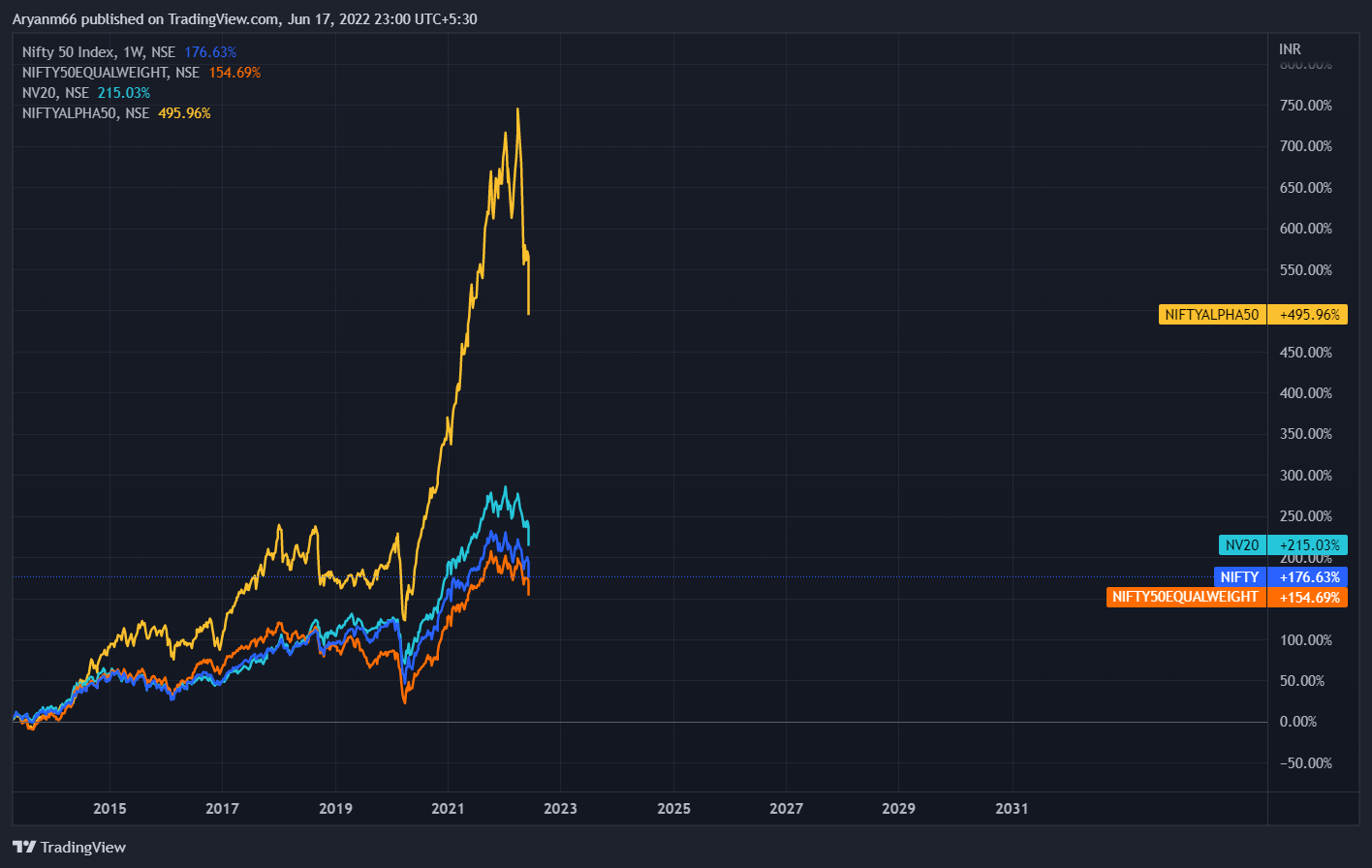

Let’s look at the price returns:

Couple of things before we compare the indices in the charts - NIFTY Alpha Low Vol is only comparable in the yearly performance due to lack of data, NIFTY 200 Quality 30 was launched in 2018 hence only comparable in 1Y and 3Y

While on the face of it, it seems like the NIFTY Alpha 50 is a clear outperformer, NIFTY50 Value 20 has also performed well

What makes this more interesting is NIFTY Alpha 50 operates on momentum and outperformance which is akin to buying growth stocks (stocks which are growing and can grow further) while the NIFTY 50 Value 20 takes a weighed approach based on ROCE, P/E, P/B and Dividend yield which is akin to buying value stocks

Now this isn’t meant to start a debate between growth stocks and value stocks, and both have performed well at different times

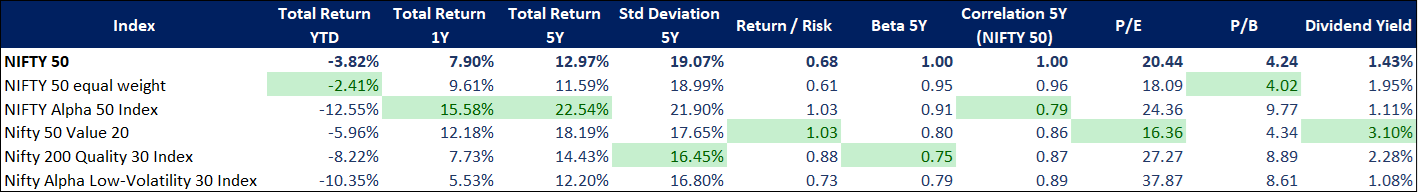

Now let’s look at the other parameters:

Since the above data is from factsheets, we can actually get the total return for the past 5 years even for recently launched indices as their base year is older

Here the winner in return seems to clearly be the Alpha 50 Index however when considered with risk, the Value 20 beats it (by a hair)

However, alpha index has fallen quite a bit more as compared to NIFTY 50, so it does suffer from drawdowns which can be quite taxing for some investors

Overall, certain style indices do seem to be outperforming NIFTY 50, in fact unlike in the case of Mcap indices where NIFTY 50 offered higher returns over the 5Y horizon alongside a good return / risk measure, here it seems to be not the best performer in any of the parameters

Conclusion

Now before anything ahead, this isn’t financial advice and also the comparison was primarily a point-to-point analysis with a lot of factors that need to be taken into account before investing in any of the above including your own risk factors, the AMC, the expense ratios, tracking errors, etc so please do consult your financial advisor

Now although our comparison is a point-to-point over various time periods so it’s not totally comprehensive, it does shed some light:

NIFTY is pretty much king when it comes to Mcap weighted indices and is actually solid choice return wise - with and without accounting for risk

Seeing as how NIFTY beats most active managers, any passive strategy beating NIFTY is a tough contender to active managers

NIFTY Alpha 50 and NIFTY 50 Value 20 seems to be two consistent style indices which can serve as alternatives to NIFTY 50 index investing

Equal weight NIFTY can really help in times when the index is polarized towards heavy weights

Phew, that was a big article, thank you for making it so far, hope this sparked curiosity and expanded your horizons on passive funds beyond the standard NIFTY Index funds and showed you an interesting side on an otherwise “Boring” field (I for one love these)

You can also check out our article last week on gold bond valuation

Till next time, keep manifesting wealth

Best,

Aryan

Disclaimer: All above views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.

Join 180+ Intellectual Readers who are manifesting wealth and are receiving their weekly manifest filled with fun and informative finance content, with premium articles access now priced for a brief period of time at Rs.99 (~$1.25)

If you want to share the gift of manifesting wealth, do share the newsletter

Sources:

Trading View

NSE