What's happening in the Indian Chemical Industry?

All views are personal and for educational purposes only, please do your own research before investing and trading

Hi,

The story of chemicals in India is one of outperformance and promise at the same time.

The sector enjoys widespread enthusiasm and positive outlook almost unanimously.

Over the last 15 years, Indian chemicals have enjoyed a tremendous run, as evident from the below chart from McKinsey:

In fact, it is one of those rare sectors which has not only survived the pandemic but also came out of it stronger.

Today we are covering the following:

What makes up the chemical industry?

The market size

What could drive it’s growth?

Financial performance of Specialty Chemicals stocks

What Makes Up the Chemical Industry?

The chemicals industry in India covers more than 80,000 products. It is largely divided into 4 sub-parts:

Commodity chemicals: Chemicals made on a large scale for general purposes (E.g. Dyes, paints, coatings, etc.)

Petrochemicals and polymers: Chemicals derived from petroleum or its derivatives (E.g. Plastics, etc.)

Agrochemicals and fertilizers: Chemicals used in agriculture (E.g. Pesticides, Plant growth regulators, Soil conditioners, etc.)

Specialty chemicals: Chemicals made for specific applications (E.g. Electronic chemicals, Food additives, Textile chemicals etc.)

The key difference between commodity and specialty chemicals is that commodity chemicals have numerous uses while specialty chemicals only have 1-2 use cases.

In addition to this, specialty chemicals are differentiated by its R&D and quality rather than its price.

Due to the above, the specialty chemical products are highly dependent on its raw materials.

All of this makes specialty chemicals a relatively low-volume but high-value product.

The Market Size

The chemical industry is estimated to have a market size of ~$212Bn as of 2021

The industry expected to be a key component of a strong domestic manufacturing sector in pushing India to be a $5Tn economy.

Currently the chemical industry contributes ~6.7% to the GDP and has an expected CAGR ~9.3% till FY2025; at which point it’d contribute ~7.2% to the GDP based on current GDP estimates

What Could Drive It’s Growth?

There has been a growing importance of specialty chemicals in the Indian chemical industry universe and India could be one of the leaders in the production of specialty chemicals in the coming years as:

Domestic availability of raw materials: Much of the raw materials used in the production of specialty chemicals is available domestically. This is a key advantage for Indian producers and contributes to the China+1 play

CapEx for product development and R&D: Indian domestic producers have been re-investing large amounts of their profits back into the businesses. This is evident by the fact that the average CapEx spend for FY18-20 was 1.5x those of FY2016-18. Most of this CapEx was spent capacity augmentation and/or product development. This CapEx spending is in addition to aggressive R&D spending to stay on top of the innovation chain in specialty chemicals

Import substitution along with export opportunity: Due to current geopolitical conditions, the global supply chain has shifted to a China+1 model of manufacturing. This has benefitted Indian manufacturers. Coupled with growing domestic demand, this will increase the top-lines of chemical manufacturers greatly

Skilled labor at low cost: India has a price advantage over other countries due to its trained labor leading to cheaper operational costs

Governmental push: To stop the importation of inexpensive, subpar chemicals into India, the government has taken steps including enforcing BIS-like certification. Furthermore, the government has excluded hazardous chemicals from 100% FDI under the automated route in the chemicals industries

Financial Performance of Specialty Chemicals

Corroborating the top-down outlook here's the market and financial performance of specialty chemical stocks in the NSE 500:

Stocks:

Market Performance:

Revenue and Profit Growth:

Capex and Returns:

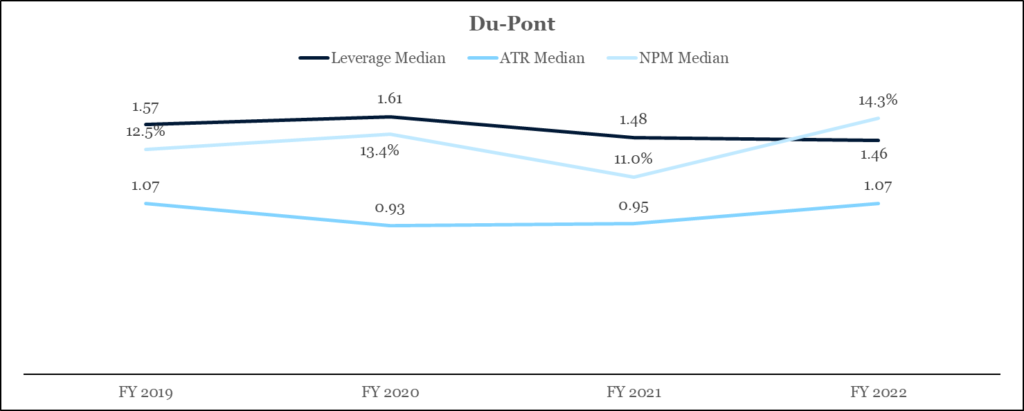

Du-Pont

Conclusion

The chemicals sector is definitely exciting looking at the numbers and the way forward, add to the fact the constant capex and R&D to be part of a China +1 play for specialty chemicals can definitely not only add to the GDP of India but perhaps also may be something that can add value to investors

This is one sector that one should perhaps look into if one hasn't already, with a long list of chemical stocks, there's good chance of finding a great opportunity

Well, that’s it for this week’s post, hope you found this insightful and made you interested in this sector!

Until Next Time, Keep Manifesting Wealth

If you liked this article subscribe to get similar articles every Sunday directly in your inbox

[newsletter_form type="minimal"]

Disclaimer: All above views are purely for educational purposes and are not to be taken as investment advice. Investment or trades taken of any kind based on this are solely the person’s risk and I bear no liability. Please consult a financial advisor before making any investments. All investments are subject to market risks.

Website: Manifestwealth.in

Twitter: @Manifest_W

LinkedIn: Manifest Wealth

Sources: